News

“Berry Producers Should Focus on B2B and Explore Distant Markets – Even as Far as Australia” – Iryna Kukhtina

Foreign Trade in Berries of Ukraine in the 2025: An Analytical Overview

The updated Catalog of Ukrainian Organic Exporters 2026 is now available!

Technological advances in growing berries and vegetables in Ukraine and the world in 2025

(Based on IBO Global State of the Blueberry Industry Report 2025)

1. Global dynamics: steady demand growth

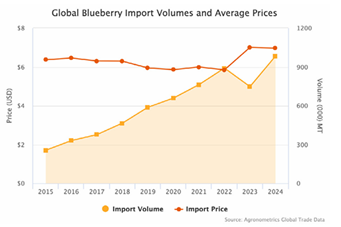

The global blueberry market continues to expand despite the climatic fluctuations of 2023–2024. According to IBO, global production in 2024 exceeded 2.15 million tons, which is about 35% higher than five years ago. The total cultivated area reached 282,000 hectares, and the growth rate remains among the highest of all berry crops.

Demand is increasing not only in traditional markets (North America, EU) but also in emerging regions such as Asia, the Middle East, and Southeast Asia. India, in particular, is becoming a fast-growing market where blueberry consumption has tripled over the past two years.

The average export price remains at the 2023 level — around $7/kg, indicating a new price threshold after the 2023 market imbalance between supply and demand. This shift is expected to have a lasting impact on the global market.

2. European context: deficit and opportunity for Ukraine

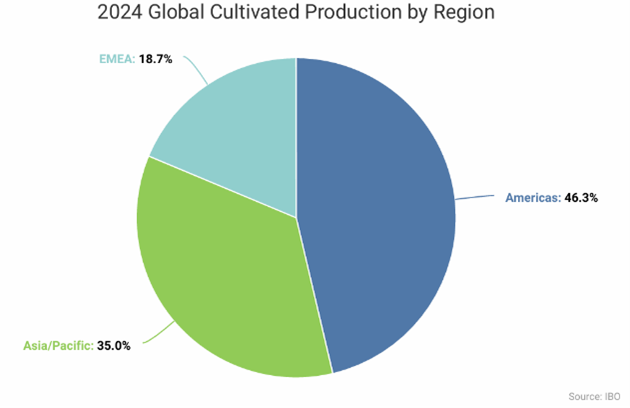

The EMEA region (Europe, Middle East, Africa) produces only 18.7% of the world’s blueberries, although its consumption is much higher. This deficit is compensated by imports from Peru, Chile, South Africa, and Poland.

However, a new trend is emerging in 2025 — European retailers are reducing air shipments, demanding products with a “low carbon footprint” and local origin. This opens a window of opportunity for Ukraine, whose “field-to-shelf” logistics chain is much shorter.

Another key advantage is geographic seasonality: Ukrainian berries ripen earlier than northern Poland’s, but later than Spain’s, filling the May–June supply gap in the European market.

3. Genetics and quality: a new breeding revolution

The global industry is shifting to a new generation of cultivars. Older open varieties that once dominated production in Poland and the U.S. (such as Duke, Bluecrop, Legacy) are gradually losing market share.

Intellectual property holders — Fall Creek, OZblu, Mountain Blue, Sekoya, and others — are rapidly expanding proprietary varieties with improved flavor, firmness, and shelf life. These varieties provide higher prices and lower post-harvest losses.

IBO emphasizes that the future belongs to “high-chill premium genetics” — varieties combining frost tolerance with the fruit quality typical of southern types (see Genetics, IBO 2025). This is particularly important for Ukraine, where climatic conditions require resilience to winter frosts and spring temperature fluctuations.

For Ukrainian nurseries, this implies the need for:

-

Partnerships with international breeding programs;

-

Development of locally adapted cultivars;

-

Control of legal propagation, as illegal use of IP-protected varieties may lead to lawsuits (IBO already reports such cases in China).

4. Production efficiency: technological maturity

With rising labor and energy costs, more producers are moving toward mechanized harvesting, even for the fresh market. IBO highlights examples from Poland, Canada, and Peru, where prototype harvesters pick berries with minimal damage (see Harvest & Technology, IBO 2025).

For Ukraine, this could be a key factor in reducing production costs. Even partial adoption of machine harvesting on industrial plantations (20–40 ha) can cut operating costs by up to 30%.

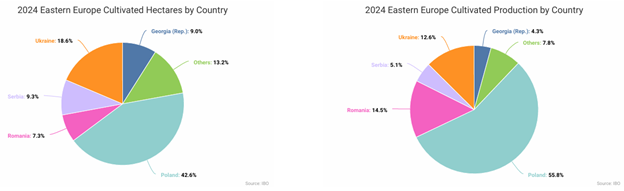

Another critical factor for Ukraine is production productivity. Despite having one of the largest planted areas in Eastern Europe, Ukraine could nearly double its output by improving cultivation efficiency. According to IBO, the average yield in Ukrainian farms remains lower than in neighboring EU countries under similar climatic conditions.

For example, Romania, with half the planted area of Ukraine, produces comparable volumes thanks to better technology, modern irrigation systems, and newer varieties.

5. ESG and sustainability: the trend shaping market access

IBO notes that climate risks and water scarcity are becoming systemic challenges for global producers (see Fig. 5, IBO 2025). Developed markets prioritize transparent product origin, efficient water use, and social responsibility.

Ukrainian farms with GLOBALG.A.P., GRASP, or Sedex certification already have an advantage in negotiations with European buyers. At the same time, they should prepare for new requirements — Carbon Footprint Reporting and Sustainability Score, which will become mandatory in 2026–2027.

Сonclusions

In summary, Ukraine’s blueberry industry has all the prerequisites to become a strong player in the European market, provided it focuses on three strategic pillars: quality, technology, and sustainability.

The key to success lies in:

-

Adopting modern genetics and premium varieties to ensure consistent quality and higher prices;

-

Implementing mechanized harvesting to reduce costs and improve efficiency;

-

Integrating ESG standards, which are becoming mandatory for European retailers.

Simultaneously, Ukraine should expand export horizons beyond the EU, targeting markets in the Middle East and Asia, and develop quality segmentation to build a recognizable “Ukrainian Premium Blueberry” brand.

As the IBO 2025 report emphasizes, success in today’s berry industry is defined not by volume, but by value — and by trust in product origin.

Association

News

Contact Us

Mytropolyta A. Sheptytskoho Str. 4, BC KOMOD, of. 49, Kyiv, 02002, Ukraine

Thank you for your attention

Ready to answer all your questions

En

En  Укр

Укр