International berry trade: how the blueberry and raspberry markets are changing

Author: Iryna Kukhtina, President of the Ukrainian Berries Association

Introduction

To truly understand what’s happening in the berry market, it's not enough to simply look at prices during the season. Berries have a short cycle from planting to harvest, and within just 3–5 years, the market landscape can change completely. Therefore, to grasp short-term trends, we need to analyze periods of 3–5 years, while major shifts should be assessed over 7–10 years. Anything longer than that is too far ahead for berries.

In this article, we’ll look at the trends in international berry trade, focusing on blueberries and raspberries — Ukraine’s key berry export products — to better understand where the market is heading.

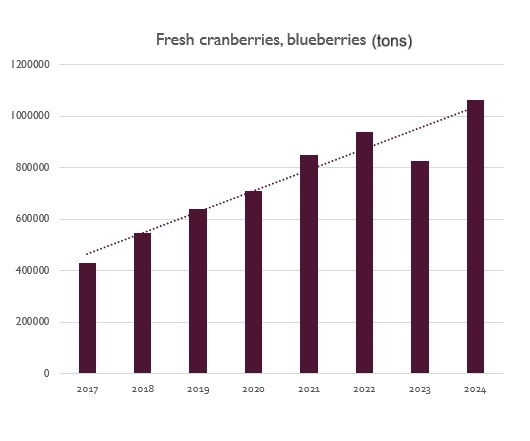

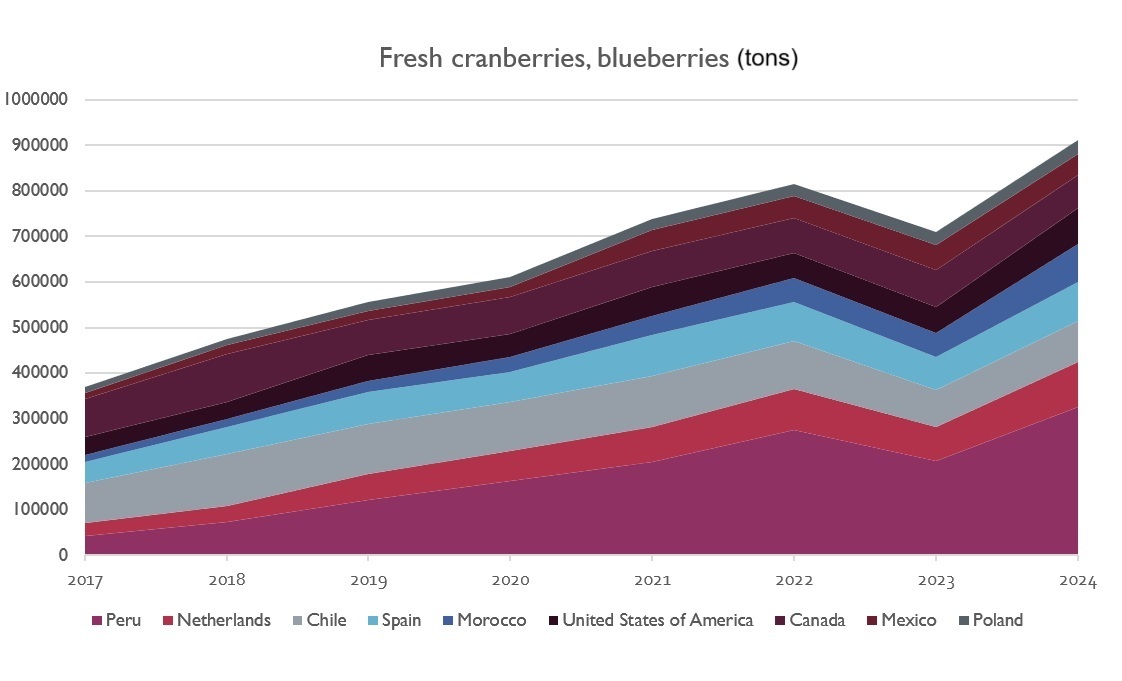

Blueberries: market growth with declining margins

First and foremost, the global blueberry market has grown rapidly. This expansion created space for new players and reshaped the balance of power. Riding this wave of growth, Peru emerged as a leading exporter, significantly increasing its production and export volumes. As a result, it captured a portion of the market from traditional suppliers, particularly Chile (which has returned to its 2017 levels) and Spain.

Among the top five blueberry exporters, only the Netherlands acts as a re-exporter, while the other countries (Peru, Chile, Poland, and Spain) are also major producers.

The issue with blueberries lies in the economics: export volumes are increasing, but prices have remained almost unchanged in recent years. Against the backdrop of global inflation, this means declining profitability. While prices for other berries are rising, blueberries are becoming less profitable, even though they continue to lead in terms of sales growth among berries.

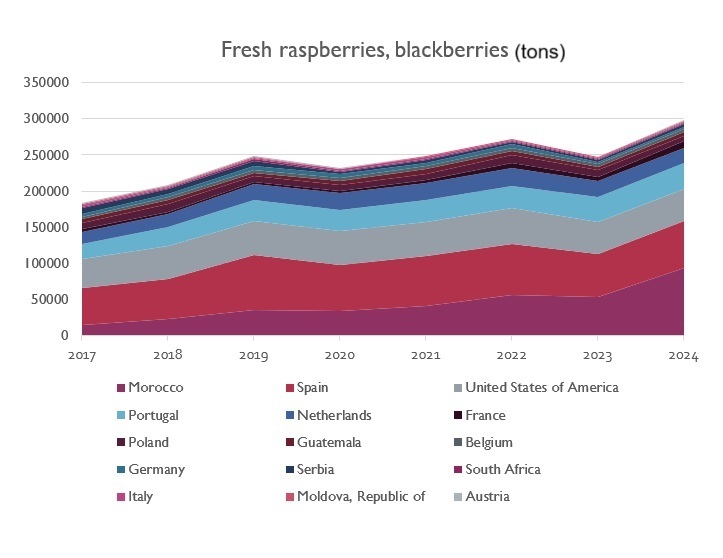

Fresh raspberries: a new market model

The global fresh raspberry market is growing, but more importantly, it has shifted its development model over the past seven years.

Poland serves as a good example: it has reduced export volumes by around 30%, yet doubled their value. The reason lies in a transition to a more modern production model that includes:

- the use of club (proprietary/commercial) varieties;

- cultivation in protected environments, including container technologies;

- contract-based production for specific export agreements.

This approach requires significant investment and creates a barrier to entry. For new farmers, entering the fresh raspberry segment is becoming increasingly difficult. In effect, the market has moved from a mass “grow-and-sell” model to a “contract-based growing” model.

The leading exporters of fresh raspberries are Morocco, Portugal, Poland, Spain, and Mexico. These countries set the tone for global pricing and quality standards.

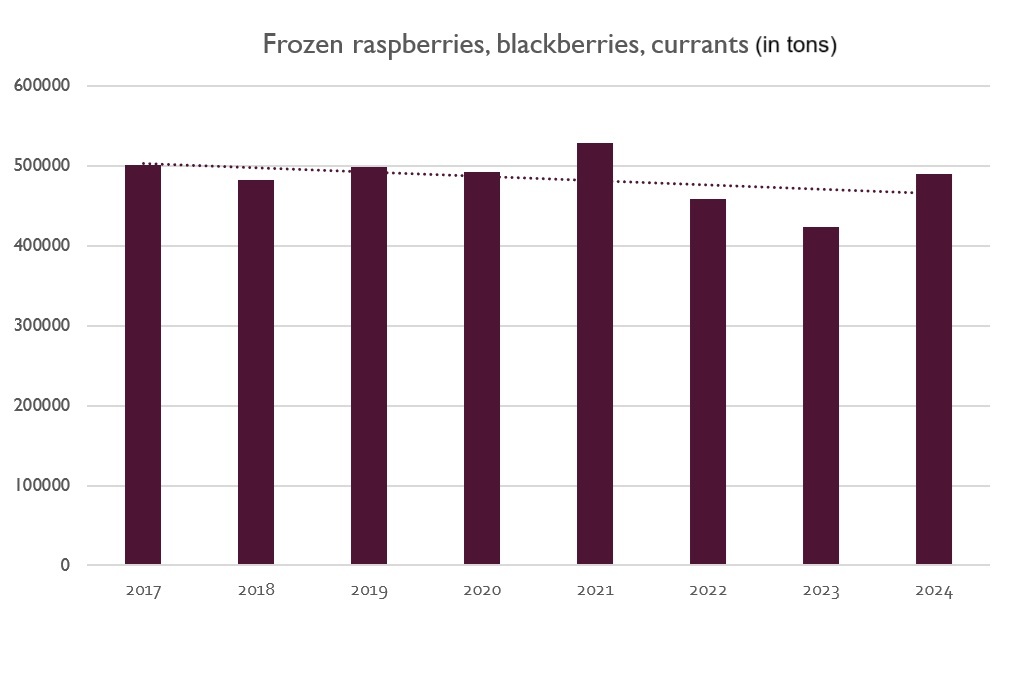

Frozen raspberries: stability with a clear price ceiling

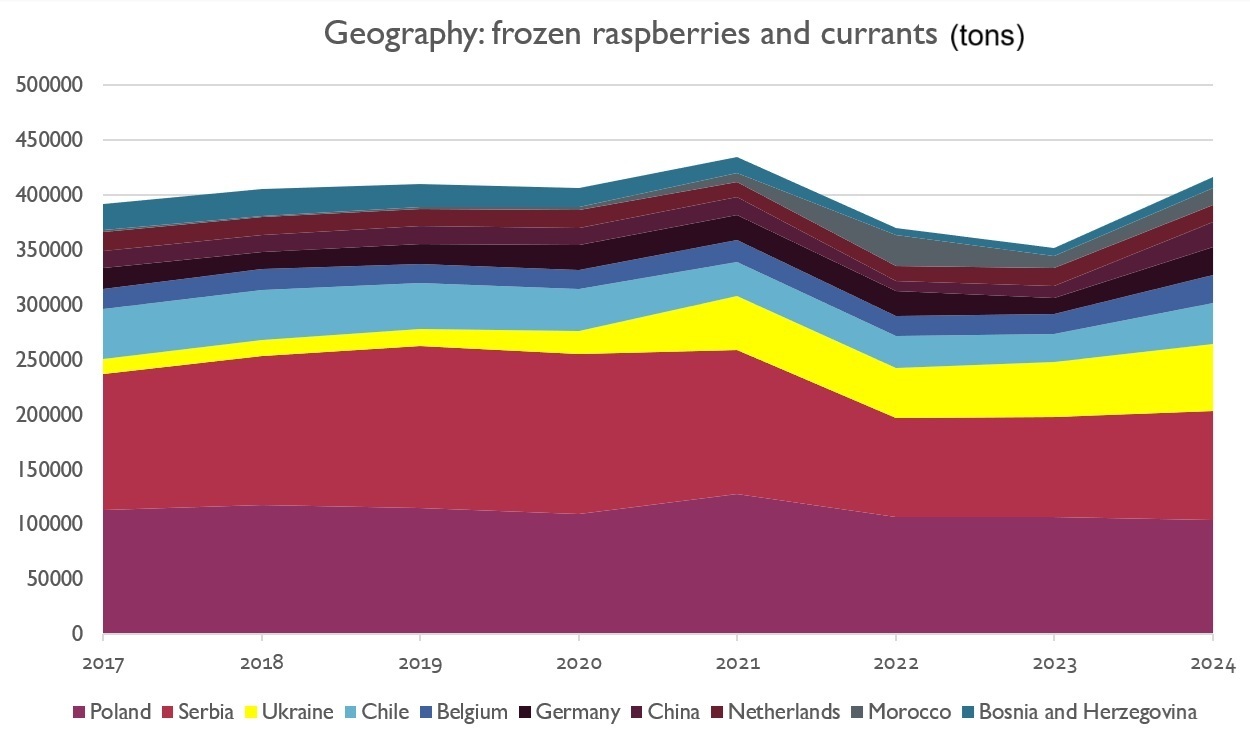

The numbers show that global demand for frozen raspberries has remained steady at around 500,000 tonnes per year. Unlike the fresh berry market, this is not a “limitless” market — it has a clear ceiling.

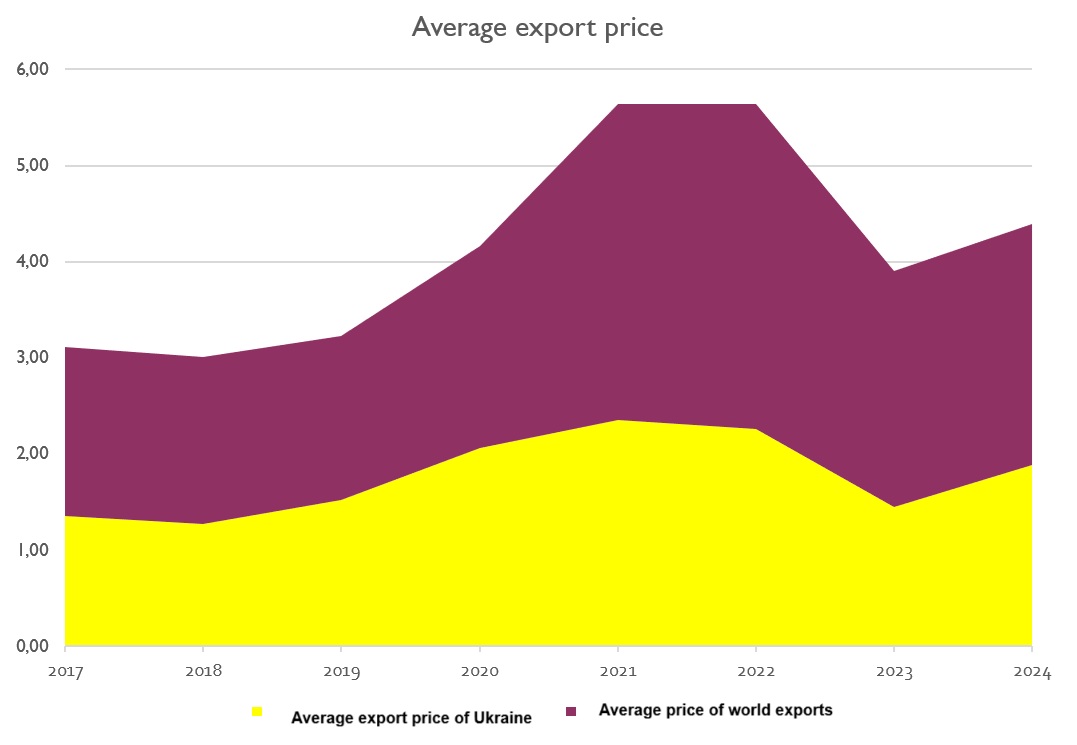

The price peak in 2022 led to a drop in volumes, and the market took two more seasons to recover. The logic is simple: frozen raspberries are an ingredient. If they are removed from a recipe due to high prices, it's not easy to bring them back quickly.

The experience of 2022–2023 clearly defined a price threshold: the market accepts prices for extra-grade frozen raspberries up to €2.8–3 per kilogram. If the price exceeds this level, demand drops sharply. This effect influences at least the following two seasons.

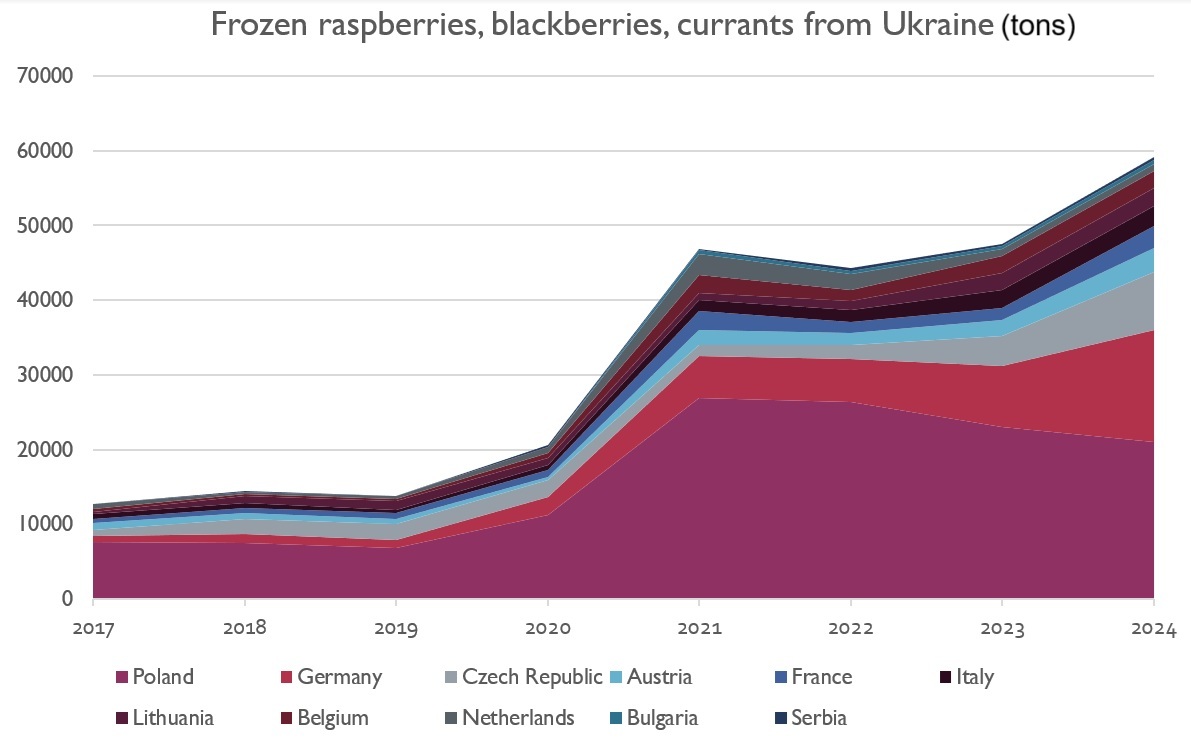

There have also been geographical shifts in this segment. Ukraine increased its volumes and displaced Serbia, which reduced its production to 60,000 tonnes in 2024. Serbia compensates for part of its exports through re-exports of berries from neighboring countries, but it was Ukrainian products that took its place — thanks to lower prices. This confirms that price dumping can quickly win market share, but it is not a sustainable strategy.

Among the main exporters of frozen raspberries, the leaders are Ukraine, Serbia, Poland, Chile, and Bosnia and Herzegovina.

Conclusions

- Blueberries: The market has grown, but profit margins are shrinking. The main issue is price stagnation amid global inflation.

- Fresh raspberries: This segment is becoming high-tech and contract-based, raising the entry barrier for new farmers. Poland demonstrates how shifting the business model can increase export value even with lower volumes. The top 5 exporters (Morocco, Portugal, Poland, Spain, and Mexico) are setting new global standards.

- Frozen raspberries: Demand remains stable at around 500,000 tonnes, but the market is extremely price-sensitive. The acceptable price ceiling is €2.8–3/kg. Ukraine has temporarily gained ground by displacing Serbia, but price dumping is not a sustainable strategy. Top 5 exporters: Ukraine, Serbia, Poland, Chile, and Bosnia and Herzegovina.

What Ukraine needs to do

- Improve product quality and meet international standards.

- Enter new price segments where value is driven by brand and consumer trust.

- Move away from price dumping as a long-term strategy.

- Increase direct exports to end markets to reduce reliance on intermediaries.

- Invest in production technologies that reduce losses and improve efficiency.

These conclusions show that the future of Ukraine's berry exports depends not on being the cheapest, but on the ability to create value — through quality, innovation, and smart positioning in new market niches.

En

En  Укр

Укр

_large.jpg)