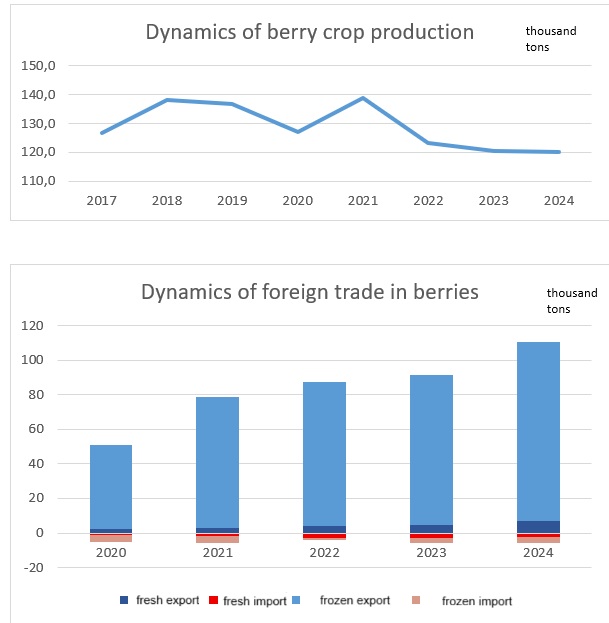

In recent years, the rate of decline in berry production in Ukraine has slowed down, despite the negative impact of external factors, including infrastructure destruction, labor shortages, and rising production costs. The main factor behind this relative stabilization has been the redistribution of production shares among different types of berries.

Due to growing global demand, Ukrainian berry exports have continued to rise: exports of fresh berries increased by 72% compared to 2022, while frozen berry exports grew by 24%.

The main importers of fresh berries are Poland (34%) and the Netherlands (28%), both of which doubled their imports from Ukraine since 2022. The share of Georgia, Germany, Moldova, and Romania is also increasing.

Frozen berries are mainly imported by Poland (35%), Germany (23%), Austria (10%), and Italy (8%). Germany and Austria have doubled their imports from Ukraine compared to 2022.

Imports into Ukraine remain insignificant and will be discussed further for specific types of berries.

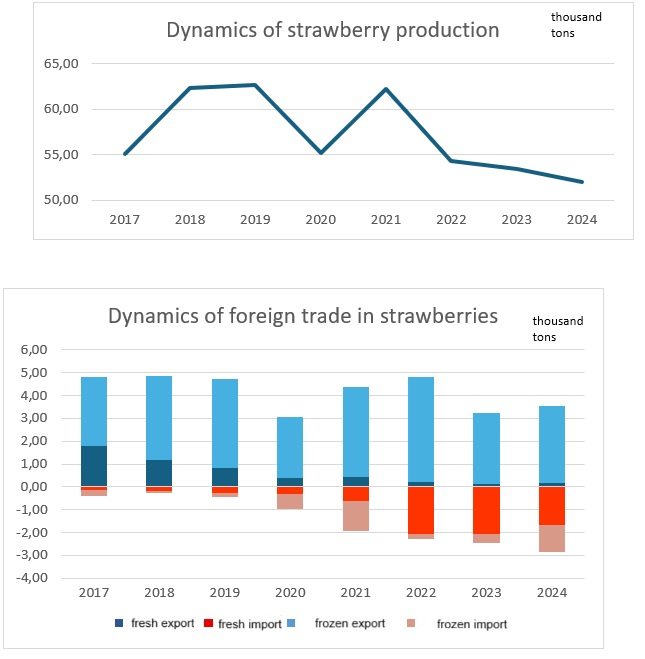

Strawberry:

In 2022, strawberry production decreased by 7.9 thousand tons, which is a 12% drop. In 2023–2024, the decline slowed and amounted to only 2 thousand tons (4%).

As production decreases, Ukraine is increasingly unable to meet its domestic demand for fresh strawberries, which drives import growth. Greece remains the main exporter, accounting for 95% of Ukrainian imports.

Exports of frozen strawberries are growing. Although they are still 20% lower than in 2022 — when stocks of pre-war production were still being exported — they have already surpassed 2023 volumes and continue to rise. The main importers are Poland (60%) and Germany (10%).

Exports of fresh strawberries continue to decline — a trend that has been noticeable since 2017. However, in 2024, there was a slight increase due to shipments to Romania, which boosted exports by 30% compared to 2023.

Imports of frozen strawberries are increasing — in particular, imports from Egypt have tripled compared to 2023.

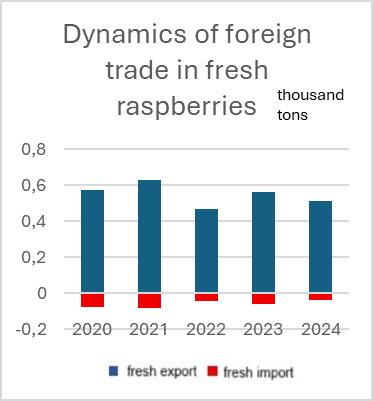

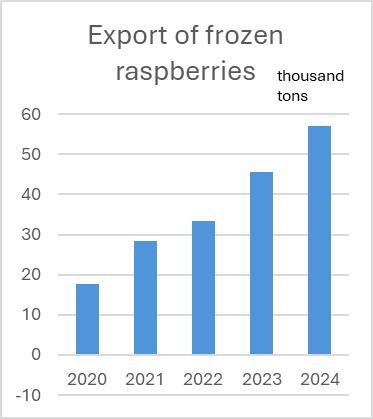

Raspberry:

Raspberry production has also declined, with total losses of 2.7 thousand tons (7.5%). However, the situation varies by enterprise.

Fresh raspberry exports have suffered more due to their smaller volumes and higher sensitivity to market fluctuations. The main importers remain Poland and the Netherlands. Since raspberry imports mainly consist of premium varieties, and demand for them has decreased, imports have declined and remain at a lower level. The main exporters to Ukraine are Spain and Morocco.

Exports of frozen raspberries continue to grow steadily — by 10 thousand tons annually. The main importers are Poland (40%) and Germany (30%), the latter of which doubled imports in 2023 and tripled them in 2024 compared to 2022. Belgium, Austria, Italy, and France have also increased their imports. Imports in this category remain insignificant.

Currant:

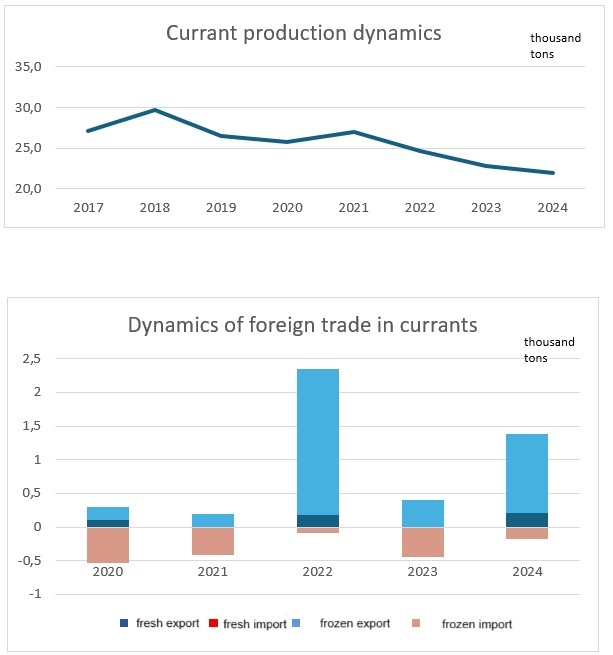

Currant production was less affected in 2022 but continues to decline by 6–7% annually.

Despite the decline in production, Ukraine has returned to 2022 levels of fresh currant exports, as European markets offer better prices than the domestic market. The main importer remains Poland, which purchases more than 90% of currants. Exports to Moldova — once a key importer of Ukrainian currants — are also recovering. Ukraine imports almost no fresh currants.

Frozen currant exports are gradually recovering, though still 40% below 2022 levels. However, they have doubled compared to 2023. The main importer is Poland (40%), followed by Germany (15%), France (5%), Austria (5%), and Italy (4%).

Imports of frozen currants have halved compared to 2023. The main exporters to Ukraine remain Germany (60%) and the Netherlands (40%).

Blueberry (Highbush):

Official statistics cover only a small portion of blueberry plantations, but they show a general trend of production growth — nearly doubling since 2022. This is due to the emergence of new plantations and the gradual increase in yields from older ones.

Fresh blueberry exports continue to grow by 2–3 thousand tons annually. The main importers remain Poland (30%) and the Netherlands (40%). The Netherlands doubled its imports in 2024 compared to 2023. The UK (5%), Moldova (5%), and Georgia (6%) also import fresh blueberries.

Ukraine has halved its imports of fresh blueberries compared to 2023. The main suppliers remain Spain, Peru, and Morocco.

Exports of frozen blueberries are recovering after infrastructure problems in 2023 and have already reached 2022 levels. The main importers are Poland (30%), Germany (20%), Austria (15%), and Italy (20%).

Ukraine imports only select premium varieties of frozen blueberries, mainly from Poland and Canada.

En

En  Укр

Укр